A major industry

Published slightly earlier than in previous years, the "Chiffres Clés de la plaisance 2023" brochure, actually compiling data for the 2021-2022 season, has been unveiled. The French Nautical Industries Federation (FIN) unveils very positive figures for the French yachting sector. We'll wait for the autumn analysis to discuss the trends that have emerged since these figures were released, in a rather more difficult context.

Over the period 2021-2022, FIN will count 5,788 companies and 42,898 employees, contributing 5.4 billion euros in sales in the nautical industry and services. The 473 marinas offered 252,000 berths, to which can be added 556 river bases for 20,000 berths and 40 dry ports for 11,000 berths.

FIN boasts 4 million regular boaters and 11 million water sports enthusiasts. 125,665 boating licenses were issued.

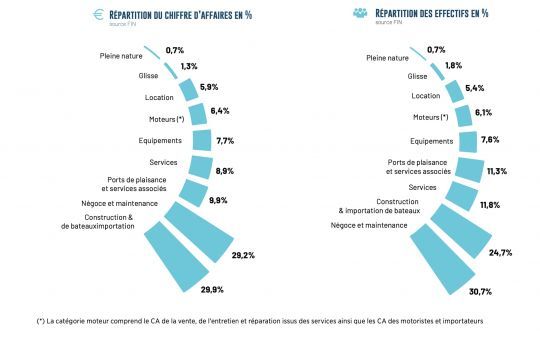

Shipbuilding, trading and maintenance account for over 50% of sales and workforce. Services and marinas follow.

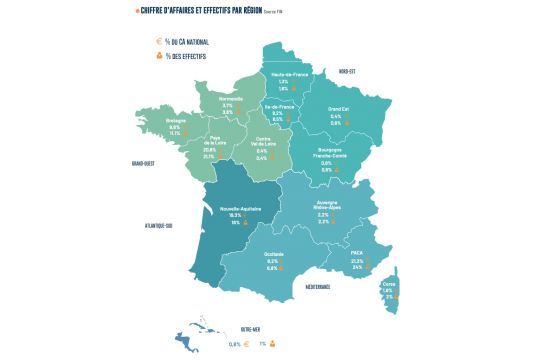

3 regions account for a significant share of the marine industry: the Southern Region or PACA accounts for almost a quarter of the workforce and 21.3% of sales, followed by Pays de la Loire with 20.8% and Nouvelle-Aquitaine with 19.3%.

Dynamic boat rental

Boat rental at sea generated 249 Meuros in 2021-22, almost half of which in France and its overseas territories. According to the FIN, nearly 1 million people rent boats all year round, more than 3/4 of them for short periods.

Short-term boat rentals with professionals generated sales of 65 million euros, while those between private individuals posted sales of 27 million euros

Bigger boats and more exports

Yacht production has exceeded its pre-Covid pandemic level. In 2021-22, it will reach 1,494 Meuros, up +20.2%. The export share is also rising, reaching 80.6%. With 45.5% of total sales, the major export markets are in the lead, with the European Union, excluding France, retaining 35.4%.

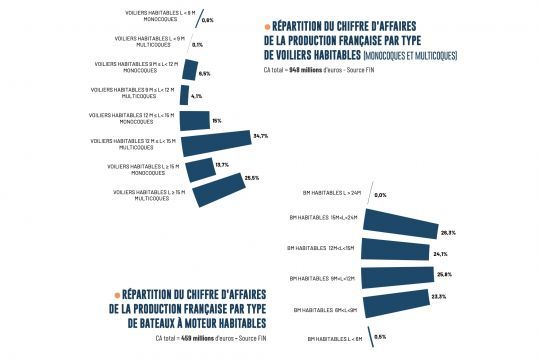

Liveaboard yachts, both multihulls and monohulls, remain the core of French production, accounting for 63.4% of sales. However, their growth is weaker than overall production, at +16% in value and only +3% in number of units. Indeed, the number of small sailboats continues to decline, with only sailboats over 12 meters showing significant growth.

Motorboats posted strong growth of +31% in sales and +6% in the number of units. The number of non-inhabitable boats fell by 3%, but sales rose by 25%. Habitable units are up in all size ranges.

Fewer boat registrations in France

After the boom of 2020-2021, the number of pleasure boat registrations in France fell in 2021-2022, by -8.61%, with 11,862 new registrations. Motorboats, which account for more than 3/4 of the pleasure craft fleet, posted -11.39% new registrations, while new sailboat registrations grew by +2.10%.

Used boat growth

In 2021-2022, the used boat market continued to grow, with 70,629 transactions, an increase of +2.7%. More than 50% of these transactions involved motorboats under 6 meters. Sailboat transactions rose sharply by +10.1%.

Despite the shortage of license places at the time, the number of boat licenses issued in 2021-22 rose by 37.45%, making up for the difficulties of the Covid period. The figures for 2021 are 101,033 coastal licenses, 20,786 inland water licenses, 3,745 offshore extensions and 101 inland water and pleasure boating extensions.

More engines

Engine sales increase in 2021-2022. 14,418 kW of 4-stroke outboard engines were sold, an increase of +25%, particularly marked in the 12 kW range. By comparison, 2-stroke outboards grew by 100%, to 454 kW.