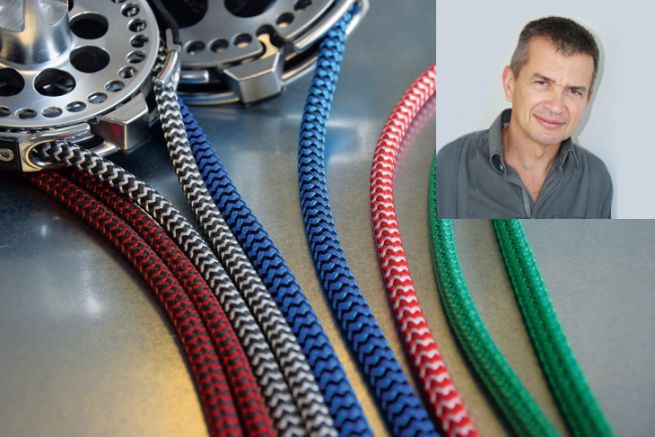

Nicolas Lancelin, head of the Corderie Lancelin, a family business from Mayenne well known in the nautical industry, answers BoatIndustry's questions on the situation of the rope market in the yachting industry and its technical, economic and ecological evolutions.

Can you give a few figures about the Corderie Lancelin and its presence in the yachting industry?

The company currently employs 35 people in France and 3 in Australia. This year we will achieve a turnover of about 5.5 Meuros. The share of the activity linked to the nautical industry is currently 70 to 80%. Our objective is to diversify so that it represents less than 50% within 3 years.

How has the Covid crisis period since 2020 been for Lancelin?

2020 went pretty well because we didn't stop working. We worked hard to take care of the teams and to continue to maintain the activity, even if the volumes were lower. It's more complicated in 2021, because the activity has picked up, but no one has made a forecast. There are supply problems: no shortage, but elastic delays. We are facing the moods of some customers, who have not anticipated a forecast, but do not understand that there are delays. The Before/After of 2020 was quickly forgotten! There is a surprising general lack of understanding. For raw materials, we had stocked up last year. In the 1980s, we still bought a little from Eastern Europe, but today almost all polyester yarns come from China or India. We depend on the textile industry. These last 6 months, prices have been very tense with increases between +10% and +25% on our raw materials, especially related to transport. We are currently making our forecasts. We may make a moderate increase in July while waiting to see how things evolve, because there is no reliable forecast after the vacations.

What developments have you seen in recent years in the yachting rope industry in general?

We're in an industry that gets a lot of criticism, sometimes unfairly. Manufacturers are trying to buy more high-end stuff on boats. Twenty years ago, we only used polyester. Today, large customers do not hesitate to invest in rope. The Covid crisis has not only hurt. The customers are less in the logic of the micro-gain, to compress the budgets. Going from 500 euros for a standard rig to 1500 euros for dyneema and more high-end ropes, it's not a big deal on the price of the boat. Some of the shipyards are also going back to Made In France. We are going to focus on that.

In terms of materials and ecological impact, what are you working on?

We are doing research. In particular, we are working with a Polynesian partner on the reintroduction of Polynesian coir rope on site. Today, when they need it, the fiber is imported. Hemp can also still have uses.

On the other hand, we have abandoned potato cellulose or PET, when we know that only 10% of plastic bottles are recycled. We are mainly working on reducing our impact in terms of waste, whether it is the coils of ends, the packaging. We must see the impact on the long term. A polyester halyard that lasts 20 years is better than a bio-sourced, over-packaged rope that lasts less time. When we deliver a standard rig to a shipyard for a boat, our goal is to have 0 packaging rather than 20 separate plastics.