A European survey on the effects of Covid-19 on boating

Since the emergence of the Covid-19 pandemic in Europe in the winter of 2020, numerous qualitative analyses have been made by experts on its consequences for the European Union's boating industry. The European Boating Industry association (EBI), which federates the national bodies of the yachting industry, has published a first study with figures on the occasion of the International Breakfast Meeting, which traditionally gathers the professionals of the sector before the Boot Dusseldorf. The results come from a survey conducted in October and November 2020 among 279 European companies, mainly in Germany, France and Spain, from all sectors of the yachting industry, from manufacturers to rental companies and equipment suppliers. Like the industry, 96% of the companies that responded are small or medium-sized enterprises.

A contrasted panorama of the consequences of the pandemic on the nautical industry

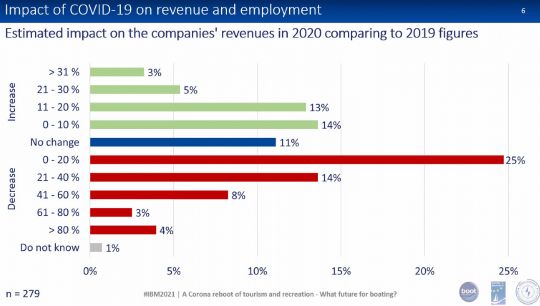

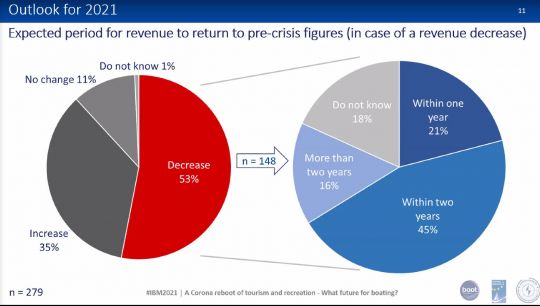

Surveyors Amelie Cesar and Natscha Zwenke asked businesses about their revenue trends. While 54% of professionals announced a decrease in 2020 compared to 2019, with a quarter of them between 0 and 20%, 35% of companies saw their revenues increase. The results vary by sector. Boat rental has been hit hard, while some distributors have seen their sales boosted in the summer of 2020.

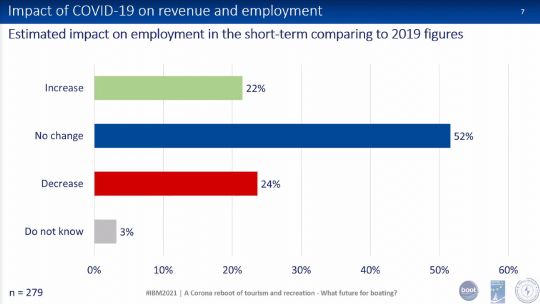

The short-term effects on employment are less marked, due in particular to the short-time working measures put in place by the states. More than half of the companies in the nautical sector have kept a stable workforce in 2020, but the effects could be felt in the longer term.

A lever for the transformation of the yachting industry?

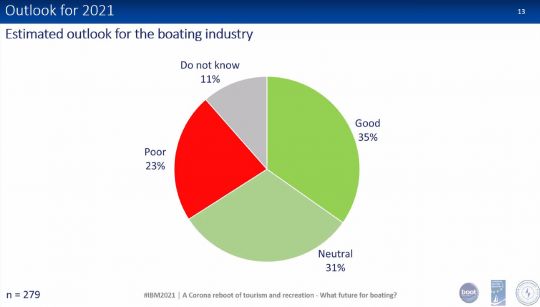

When asked about the long-term effects, entrepreneurs are optimistic. Among the companies that have seen their revenues decrease in 2020, 66% of them believe that they will be able to return to their pre-crisis level within 2 years. 35% of the companies consider the future of boating as good and only 23% negative.

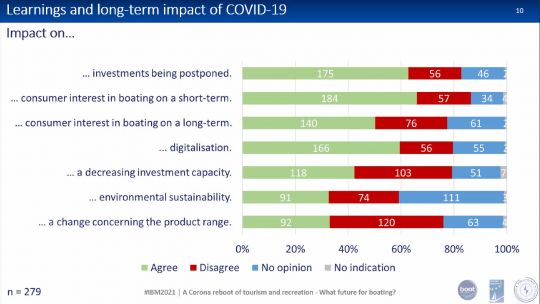

The interviewers asked the respondents about several statements. It appears that more than 60% of them have postponed their investments and more than 40% have seen their investment capacity decrease. While digitalization has been accelerated for 60% of the sample, other subjects seem to be less impacted, such as product developments and sustainable development policy (30% only). To conclude on a positive note, half of the professionals count on a long-term effect on customers' interest in boating.