An analysis of the post-Covid-19 boating market

The exercise of predicting the future of the yachting market is always complex, especially in the context of the crisis linked to the Covid-19 pandemic. While the conclusions may vary from one analyst to another and from one month to the next, the Interconnection Consulting report has the merit of presenting hypotheses based on consultations conducted in the spring, in the midst of the crisis. While the recovery appears to be taking shape more quickly, its conclusions allow us to envisage a degraded scenario.

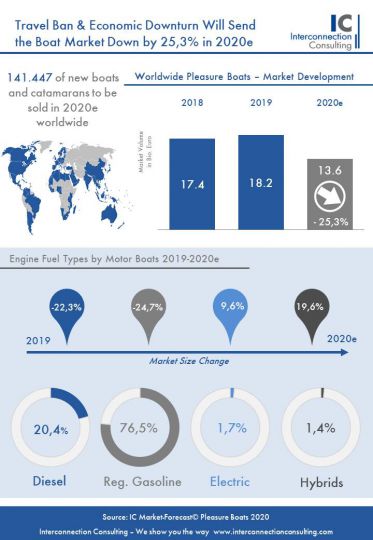

Boat sales down 25%

The firm concludes that the sale of pleasure boats, both sailing and motor, has fallen by a quarter worldwide. If the distribution is not homogeneous geographically, Europe and the United States, the world's main markets, should be strongly impacted. China and South-East Asia would be spared, but account for less than 10% of world sales.

Yachts mainly impacted

The analyst Jan Hudak anticipates a 29% drop in sailboat sales. Catamarans, which are globally less impacted, would only fall by 18%, while motor boats would fall by an average of 25%. As is often the case in crises, the effects of the Covid 19 should reinforce the trends already noted. The emergence of hybrid and electric boats should accelerate. Interconnection Consulting forecasts growth of 19.6% and 9.6% respectively in 2020.

Small shipyards in difficulty

Of the 1,500 global boat builders he has identified, Jan Hudak is predicting many disappearances. The main difficulties are expected to be in small shipyards, dependent on a small number of customers. But the turbulence already experienced by the major shipyards, many of which have changed direction in 2019, from the Bénéteau Group to Sunseeker, Princess Yachts, Baltic Yachts and Amels, will also continue. While the analysis pays little attention to employment, there are also fears of numerous redundancies in the yachting sector.