On the occasion of his back-to-school conference, Hervé Gastinel, President of the Bénéteau Group, gave an exclusive interview to BoatIndustry. In this 2nd part ( see the first part of the interview here ), it outlines the industrial strategies and brand positioning of this heavyweight in the marine industry.

You have acquired a major factory in Poland through the purchase of Delphia. What is the Bénéteau Group's strategy for producing its boats on a larger scale?

We are making major industrial investments to increase the flexibility of our factories by producing different models. We also want to produce as close as possible to our customers, by matching production levels to sales levels. With the acquisition of Delphia, we are strengthening our position on the Polish market, with development and prototyping capacity. We have also reopened a former RBH Group factory in Cadillac, which has been closed since the 2008 crisis. This adds a capacity of 1,000 boats per year in the United States. Even if the Asian market is not yet mature, we must be prepared for it. We have regrouped the commercial part in Hong Kong and a production site could be set up within two years. The priority today remains Europe and the United States.

What is the future of the newly acquired brands Seascape and Delphia?

Sescape is not a global brand, but a community brand. Much has been done, particularly in France and Germany, to federate and animate the network. We will continue to work in France with François Coutant, the Seascape distributor. We are delighted to integrate a good team and an architect, Sam Manuard, with whom we had never collaborated. Secondly, the future of Seascape is clearly in First (Editor's note: the Seascape yachts have been renamed First and redecorated since the acquisition) From an industrial point of view, the boats are to a large extent subcontracted and we are examining whether it is more appropriate to go back into production.

As far as Delphia is concerned, there are many great brands like Bluescape, Escape or Nano. We are conducting a full investigation to see how to integrate them into our range.

How will the production of the Lagoon, Excess and CNB be organized? What is the status of one-off production in Bordeaux? What about the sea serpent of a move to the Mediterranean?

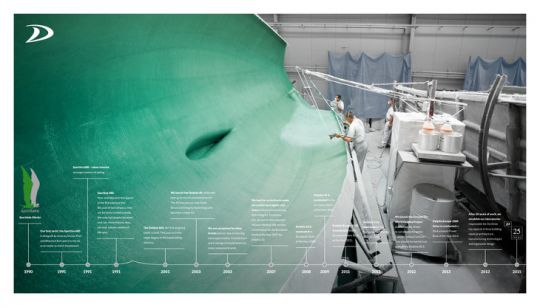

The launch of the Excess catamarans took time to create the range, but also because of the production challenges. We doubled our production capacity last year, with 800 multihulls between Bordeaux and Vendée. The Excess catamarans will not have a dedicated manufacturing site.

A reinforcement of CNB Lagoon towards the Mediterranean is not excluded. But the transport problem does not require this location. On the other hand, we encourage initiatives like the expansion of our supplier Sailing Atlantique Services in Canet en Roussillon.

The CNB one-off boat business is now dormant. There has been a lot of activity, notably with the 90-foot CNB project, and the priority remains the Lagoon, CNB and Excess ranges.

You release many new models. Is this race for novelty necessary?

I think so. The automotive groups have been criticized a lot for having declined because of this. The investment is 1.5 to 2 million euros per new model for several hundred boats. These are not gadget innovations. Only a group with the industrial capacity, capable of synergies allowing the mutualization of development costs and with a worldwide network can maintain such a renewal rate over several years. The second-hand market is pushing us to differentiate ourselves.